-

Financial reporting and accounting advisory services

You trust your external auditor to deliver not only a high-quality, independent audit of your financial statements but to provide a range of support, including assessing material risks, evaluating internal controls and raising awareness around new and amended accounting standards.

-

Accounting Standards for Private Enterprises

Get the clear financial picture you need with the accounting standards team at Doane Grant Thornton LLP. Our experts have extensive experience with private enterprises of all sizes in all industries, an in-depth knowledge of today’s accounting standards, and are directly involved in the standard-setting process.

-

International Financial Reporting Standards

Whether you are already using IFRS or considering a transition to this global framework, Doane Grant Thornton LLP’s accounting standards team is here to help.

-

Accounting Standards for Not-for-Profit Organizations

From small, community organizations to large, national charities, you can count on Doane Grant Thornton LLP’s accounting standards team for in-depth knowledge and trusted advice.

-

Public Sector Accounting Standards

Working for a public-sector organization comes with a unique set of requirements for accounting and financial reporting. Doane Grant Thornton LLP’s accounting standards team has the practical, public-sector experience and in-depth knowledge you need.

-

Tax planning and compliance

Whether you are a private or public organization, your goal is to manage the critical aspects of tax compliance, and achieve the most effective results. At Doane Grant Thornton, we focus on delivering relevant advice, and providing an integrated planning approach to help you fulfill compliance obligations.

-

Research and development and government incentives

Are you developing innovative processes or products, undertaking experimentation or solving technological problems? If so, you may qualify to claim SR&ED tax credits. This Canadian federal government initiative is designed to encourage and support innovation in Canada. Our R&D professionals are a highly-trained, diverse team of practitioners that are engineers, scientists and specialized accountants.

-

Indirect tax

Keeping track of changes and developments in GST/HST, Quebec sales tax and other provincial sales taxes across Canada, can be a full-time job. The consequences for failing to adequately manage your organization’s sales tax obligations can be significant - from assessments, to forgone recoveries and cash flow implications, to customer or reputational risk.

-

US corporate tax

The United States has a very complex and regulated tax environment, that may undergo significant changes. Cross-border tax issues could become even more challenging for Canadian businesses looking for growth and prosperity in the biggest economy in the world.

-

Cross-border personal tax

In an increasingly flexible world, moving across the border may be more viable for Canadians and Americans; however, relocating may also have complex tax implications.

-

International tax

While there is great opportunity for businesses looking to expand globally, organizations are under increasing tax scrutiny. Regardless of your company’s size and level of international involvement—whether you’re working abroad, investing, buying and selling, borrowing or manufacturing—doing business beyond Canada’s borders comes with its fair share of tax risks.

-

Succession & estate planning

Like many private business owners today, you’ve spent your career building and running your business successfully. Now you’re faced with deciding on a successor—a successor who may or may not want your direct involvement and share your vision.

-

Tax Reporting & Advisory

The financial and tax reporting obligations of public markets and global tax authorities take significant resources and investment to manage. This requires calculating global tax provision estimates under US GAAP, IFRS, and other frameworks, and reconciling this reporting with tax compliance obligations.

-

Transfer pricing

Recognized as a leader in the transfer pricing community, our award-winning team can help you expand your business beyond borders with confidence.

-

Transactions

Our transactions group takes a client-centric, integrated approach, focused on helping you make and implement the best financial strategies. We offer meaningful, actionable and holistic advice to allow you to create value, manage risks and seize opportunities. It’s what we do best: help great organizations like yours grow and thrive.

-

Restructuring

We bring a wide range of services to both individuals and businesses – including shareholders, executives, directors, lenders, creditors and other advisors who are dealing with a corporation experiencing financial challenges.

-

Forensics

Market-driven expertise in investigation, dispute resolution and digital forensics

-

Cybersecurity

Viruses. Phishing. Malware infections. Malpractice by employees. Espionage. Data ransom and theft. Fraud. Cybercrime is now a leading risk to all businesses.

-

Consulting

Running a business is challenging and you need advice you can rely on at anytime you need it. Our team dives deep into your issues, looking holistically at your organization to understand your people, processes, and systems needs at the root of your pain points. The intersection of these three things is critical to develop the solutions you need today.

-

Creditor updates

Updates for creditors, limited partners, investors and shareholders.

-

Governance, risk and compliance

Effective, risk management—including governance and regulatory compliance—can lead to tangible, long-term business improvements. And be a source of significant competitive advantage.

-

Internal audit

Organizations thrive when they are constantly innovating, improving or creating new services and products and envisioning new markets and growth opportunities.

-

Certification – SOX

The corporate governance landscape is challenging at the best of times for public companies and their subsidiaries in Canada, the United States and around the world.

-

Third party assurance

Naturally, clients and stakeholders want reassurance that there are appropriate controls and safeguards over the data and processes being used to service their business. It’s critical.

Ensuring the shares of your company are considered small business corporation (SBC) shares or qualified small business corporation (QSBC) shares is important because it may entitle you to beneficial tax treatment under certain circumstances. In this article, we’ll share more about what the SBC and QSBC status means and four reasons why it’s important for small business owners:

- The lifetime capital gains exemption (LCGE)

- Avoiding the tax on split income (TOSI) on the sale of shares

- Avoiding the punitive corporate attribution rule

- Claiming an allowable business investment loss (ABIL)

What is an SBC and a QSBC?

Small business corporation

Generally, if your corporation is a Canadian-controlled private corporation (CCPC) that uses all of its assets in an active business in Canada, your corporation likely qualifies as an SBC. However, if some of your company’s assets aren’t being used to earn active business income, then the corporation may not qualify.

Specifically, to be considered an SBC, you must:

- Be a CCPC

- Use at least 90% of the fair market value (FMV) of the corporation’s assets in an active business that conducts business primarily in Canada (i.e., at least 50%).

A holding company can also qualify as an SBC if 90% or more of the FMV of its assets are shares or debts in a corporation that is an SBC.

Example: If your business has excess cash that it invests in marketable securities, these assets would likely not count as being used to earn active business income, which could put your corporation’s SBC status at risk.

Furthermore, since the 90% test is applied to the FMV of assets rather than cost or book value, you may require professional valuation services to ensure you are using the correct values when evaluating the corporation’s SBC status. Also, consider goodwill, which may have a fair market value, but may not be included on a historical cost balance sheet.

Qualified small business corporation

For shares to be considered QSBC shares, three tests need to be met:

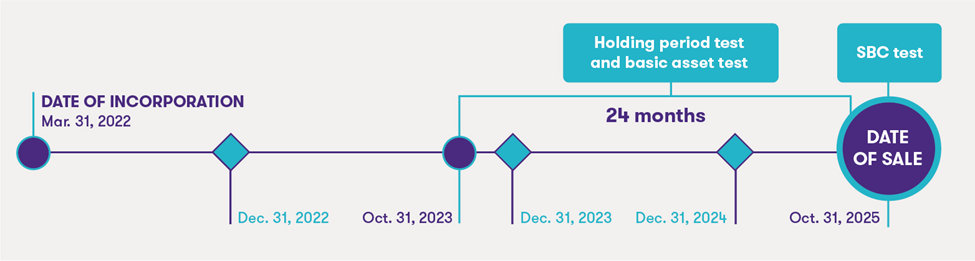

The SBC test: The corporation must be an SBC at the “particular time” (i.e., any point in time in which it is necessary to determine QSBC status). For example, where shares are being sold, the particular time would generally be the date of disposition.

The holding period test: The shares of the corporation must be owned by the individual, or a person or partnership related to the individual, throughout the 24 months prior to the particular time

The basic asset test: The corporation must be a CCPC throughout the 24 months prior to the particular time and at least 50% of the FMV of its assets must have been used principally in an active business in Canada (or be shares or debts in a corporation that is an SBC).

Example:

Ms. A incorporated their sports gear retail business, The North, Inc. (TNI) on March 31, 2021. Ms. A was recently approached by a competitor who would like to purchase her shares of TNI. The proposed closing date for the sale is October 31, 2025. The following timeline illustrates the timing requirements of each of the three QSBC tests.

Why do you want SBC or QSBC status?

The lifetime capital gains exemption

If you own shares of a QSBC, the LCGE is an effective tool to reduce or eliminate your tax bill that would otherwise be payable upon the sale or succession of your company.

The LCGE allows a Canadian resident individual to shelter gains on the disposition of QSBC shares. The amount of the LCGE is indexed to inflation and adjusted annually. The exemption is also available on “qualified farm property” and “qualified fishing property”, on up to $1.25 million in gains as of June 25, 2024.

An example of the benefits when selling a business

Although there are many ways to structure the sale of a business, one of the simplest ways is for the business owner to sell shares to the purchaser. If the shares are SBC or QSBC shares, a business owner can benefit from the tax savings provided by the LCGE.

In this example, we illustrate the potential tax savings in Ontario:

Mr. B has been approached by a buyer that’s offered to purchase his business, Hoops Inc. The buyer offered $1.5 million for the shares of his corporation. Mr. B originally incorporated his company a decade ago for $100. Since his business is based in Ontario, his combined federal and provincial personal tax rate is 53.53%.

| SCENARIO 1: LCGE applied | SCENARIO 2: no LCGE |

|

|---|---|---|

|

Sale proceeds

|

1,500,000

|

1,500,000

|

|

Less cost of shares

|

(100)

|

(100)

|

|

Capital gain

|

1,499,900

|

1,499,900

|

|

Taxable portion (50%)

|

749,950

|

749,950

|

|

Less capital gains deduction

|

(625,000)

|

-

|

|

Net amount taxable

|

124,950

|

749,950

|

|

Tax @ 53.53%

|

66,886

|

401,448

|

In this example, the capital gain deduction is deducted from the taxable capital gain to determine the amount of the gain that is subject to tax. The capital gain deduction of $625,000 is 50% of the lifetime capital gain exemption of $1,250,000.

The potential tax savings in this scenario is over $334,000. Note that the results vary, depending on the province. This example also doesn’t include the alternative minimum tax (AMT), which would likely apply in this scenario; however, even with AMT, there’s still the potential for substantial tax savings.

Tax planning for you and your family

To avoid future uncertainties, some business owners may prefer to “lock-in” the benefit of the LCGE at a time when they are certain that their companies have QSBC status. This can be done through what is referred to as “crystallization” of the LCGE. The simplest way to do this is by transferring your QSBC shares of your operating company (Opco) to a holding company (Holdco) and electing to trigger a gain large enough to use your available LCGE. Opco shares will now have a higher tax cost, which will reduce the capital gains on a future sale of the shares.

It may also be possible to multiply the benefit of the LCGE by having other family members own shares in Opco too. Under the right circumstances, this could result in significant tax savings, as each individual family member would be able to exempt up to $1,250,000 of capital gains on their QSBC shares. For a family of four, that results in $5 million of capital gains exempt from tax.

Strategies can also be implemented that use a trust to allow for flexibility and control in your tax planning. However, professional advice is key when considering these strategies, as having family members who aren’t active in the business own shares in the corporation can result in negative tax consequences due to TOSI.

Avoiding the tax on split income

It’s particularly important to maintain your company’s QSBC status when you are considering estate planning or anticipating a sale in the near future. The TOSI rules are punitive and complicated, and getting professional help can allow you to mitigate the potential negative impacts of the rules and explore potential tax planning opportunities.

If the TOSI rules apply, split income is taxed at the top personal marginal tax rate and isn’t eligible for any deductions or credits, except for the dividend tax credit and foreign tax credit. However, a major exception to TOSI is the exemption for gains incurred on the sale of QSBC shares, provided the gain isn’t incurred by a minor on a sale to an individual related to the minor (or a corporation or trust, if controlled by a person related to the minor).

Furthermore, there’s no requirement to actually claim the LCGE when disposing of the shares, which may allow for tax planning opportunities on these shares.

Avoiding the corporate attribution rule

If your business is incorporated and you plan to add other family members as shareholders or implement an estate freeze, it’s possible that the corporate attribution rules will apply. These rules are punitive as they result in imputed interest or “phantom income” being included in your income, whether or not you actually received any amount from the corporation. In addition, there’s no corresponding deduction to the corporation, resulting in double taxation.

For example, if you and your spouse each own 50% of your corporation and then you loan $1 million to the corporation, this could result in imputed interest being included in your personal income. Assuming the loan is outstanding from the beginning of the year, and the current prescribed rate is 4%, this would result in a $40,000 interest income inclusion on your personal tax return.

Although there are several methods that can be used to alleviate the impact of these rules, the simplest one is ensuring that the corporation is an SBC. Specifically, if the shares are SBC shares then the shareholder can loan to the corporation without the rules applying.

Allowable business investment loss

If you have invested in a company by buying shares or lending money but your investment turns out to be a dud, there’s the potential to write-off half of the loss on your investment as a tax deduction. This write-off—known as an allowable capital loss—has limited deductibility.

However, if the company you invested in is an SBC, the write-off could instead be considered an allowable business investment loss (ABIL), which allows for more opportunity to receive the benefit of the write-off sooner.

An ABIL is deductible against any source of income and if no income is available in the current year, can be deducted against any income source in the three previous years or the next 10 years. After that time, it will still be available as a deduction, but in a more limited capacity. Therefore, the likelihood of receiving the benefit of the ABIL sooner rather than later is much higher than if it were not an ABIL.

How to maintain SBC or QSBC status

Given the benefits of qualifying as an SBC or QSBC, it’s critical to keep an eye on your balance sheet and make sure your non-active business assets don’t risk the status of your company.

Whether an asset is used in an active business or not can sometimes be subjective. One asset that can be difficult to assess is cash. Cash is considered to be used in active business if its withdrawal would destabilize the business. For example, if the cash is used as certificates of deposits required to be maintained by a supplier or the cash is anticipated to be used to purchase capital assets or repay debts, it will usually be considered as an active business asset. However, if your company has excess cash and you don’t have plans to use it in your business operation, the cash will not be considered as an active business asset.

Other types of assets that could risk your company’s SBC or QSBC status include:

- Investments (e.g., long-term bonds)

- Rental property (e.g., a portion of the building is rented out to businesses other than associated small business corporations)

- Leased equipment when a corporation isn’t in the equipment leasing business (e.g., equipment leased on a regular basis to businesses other than associated small business corporations)

- Vehicles (e.g., when they’re used by employees or shareholders for personal use more than 50% of the time)

Know what’s on your balance sheet and plan ahead

If your corporation doesn’t currently meet the definition of SBC or QSBC, there are ways to achieve this. Reviewing your balance sheet to determine what changes need to be made is a good starting point. For example, if you have a large cash balance, it may be necessary to evaluate the reason for the large balance and potentially determine ways to use the cash. For example, paying off liabilities or paying dividends to shareholders to ensure you’re meeting the requirements in the SBC definition.

Helping you reach your long-term financial goals is our priority at Doane Grant Thornton. When done in advance, tax planning can both support and guide your decisions in a way that will maximize returns and help you avoid unexpected pitfalls.

Visit our Helping businesses gain financial clarity and confidence hub for more insights.